Features

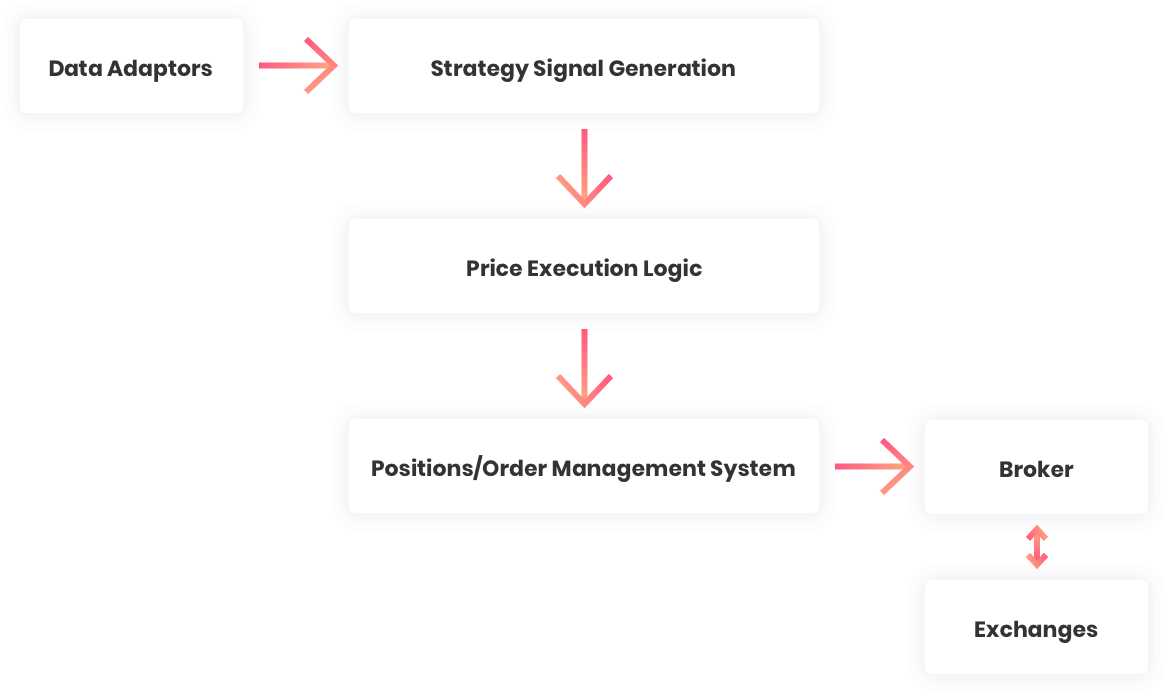

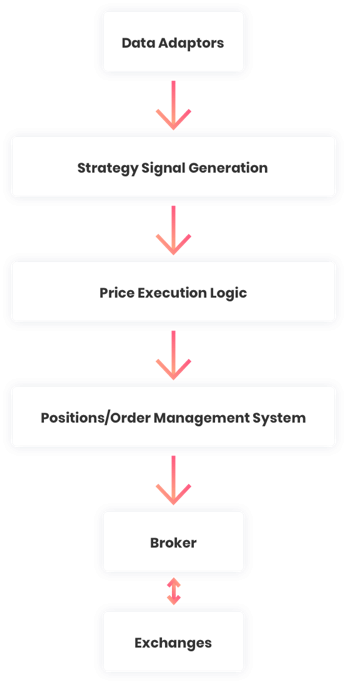

Trading Engine

You set the conditions in your strategy and leave the rest to us. We will check them constantly (as soon as a new price tick arrives for any instrument in your strategy) and once any conditions (Entry / Repair / Exit) are satisfied, the trades are taken. Thanks to our trading engine, all of this can be handled with ease and you will never again worry about missing an opportunity. A state of the art distributed architecture which can span multiple servers all hosted on the cloud is at work to see that your strategy is given all the attention it deserves. Every strategy has a dedicated bot working on it so even if the system has 1 strategy to take care or 1 million, the architecture which automatically scales the servers based on the load at hand, takes care that there is no latency issue your strategy faces.

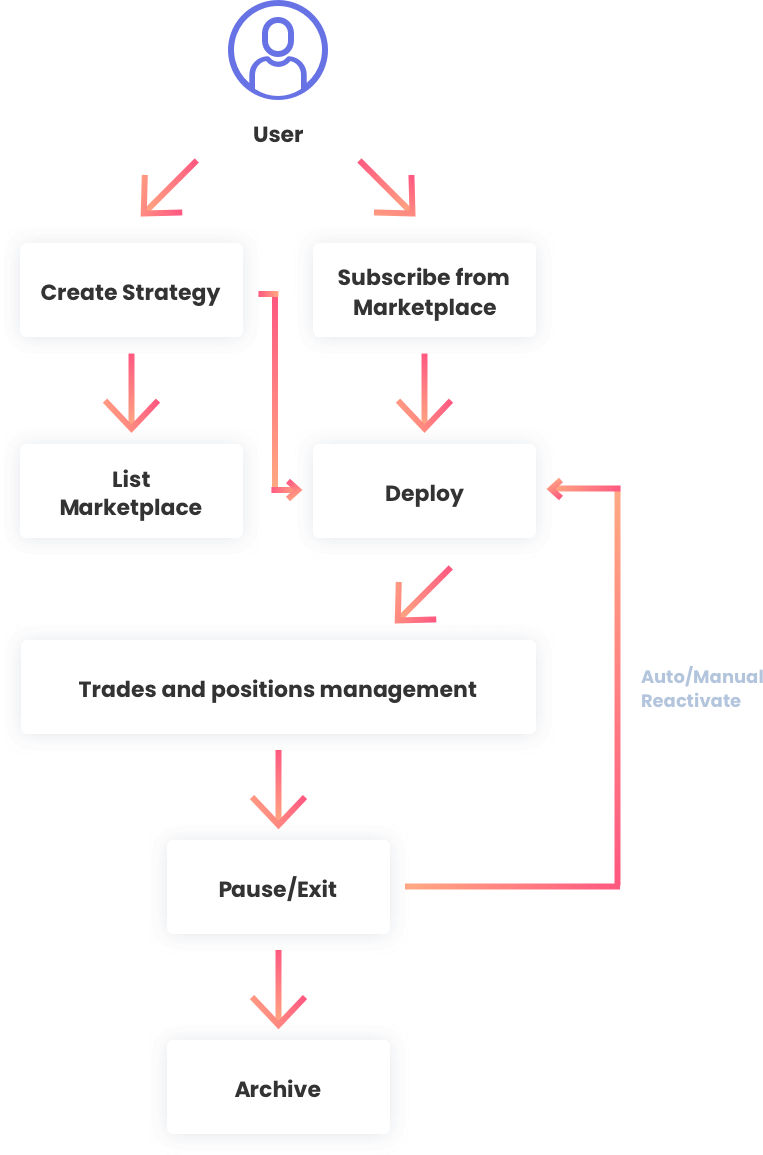

Social Trading

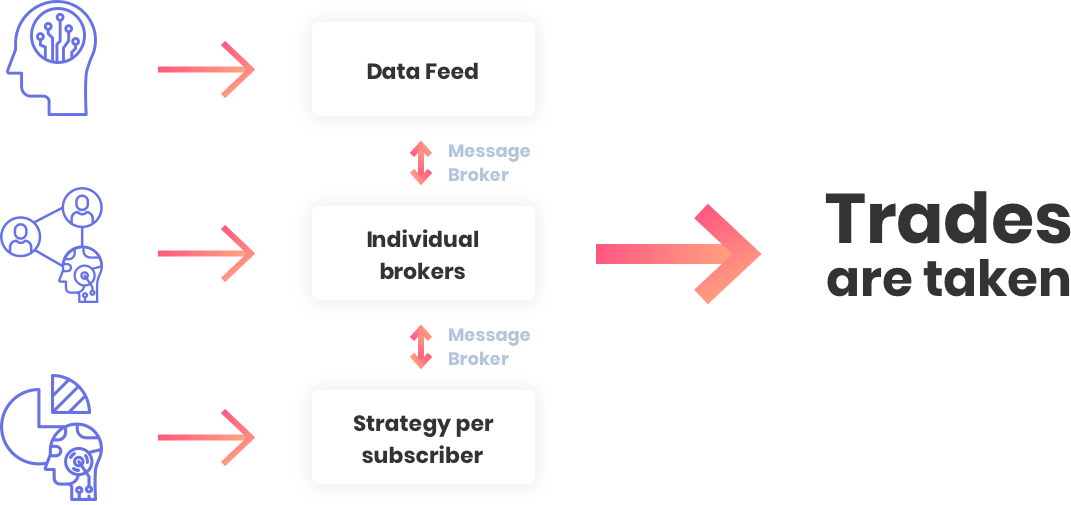

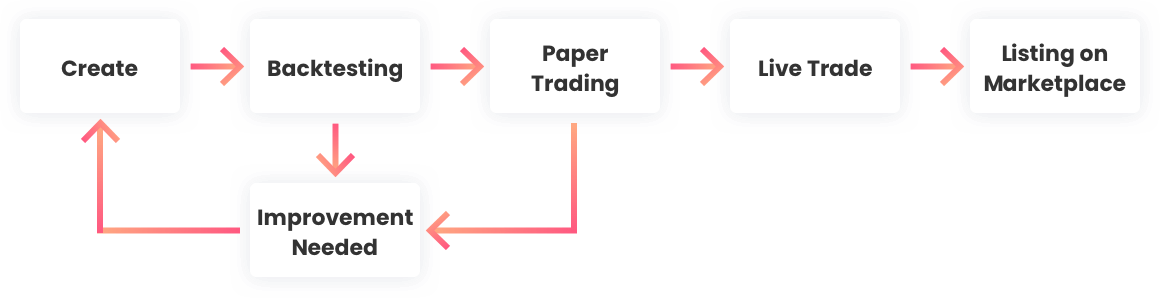

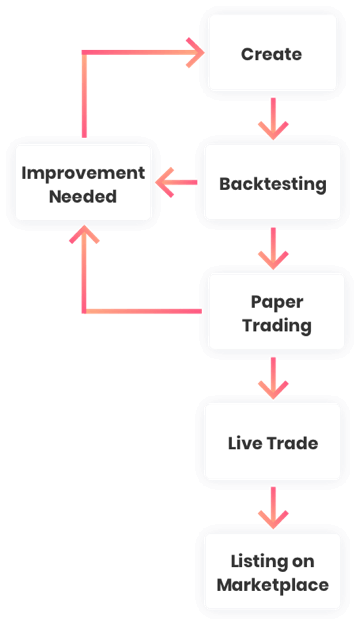

If you’re new to the market, social trading is what you need. At its simplest it allows you to sift through hundreds of strategies, see key statistics and choose the ones you want to add to your portfolio. Since all the data is transparently available you can take into consideration additional factors, such as trading strategy past performance, backtesting results and asset-types.

By enabling users to copy one another, Tradetron makes it easy for those who lack time or even the know-how to trade online. Simply follow another traders strategy, anything they do is automatically replicated in real-time in your portfolio.

As an investor instantly gain access to multiple strategy providers and execute your strategies directly through your own brokers account.

Search for a strategy using the powerful filtering tools, subscribe to a strategy which suits your trading style and you are all set!